Digitization Impacts the Trajectory of IT Acquisitions

Streams ‘R’ Us: Distributed Data Processing in the 21st Century

April 23, 2017

Product Management in the Digital Age: Lessons from Pyramids and Canals

June 13, 2017We wake up routinely to the news of one acquisition or another. Most stories repeat the refrain, “Big fish bought little fish”. We hit snooze and move on. Lately though, the world of IT acquisitions have gotten more interesting, in part due to digitization. Applying information technology by industries to modernize their offerings and operations has brought forth a new breed of big fish to the buyers’ table.

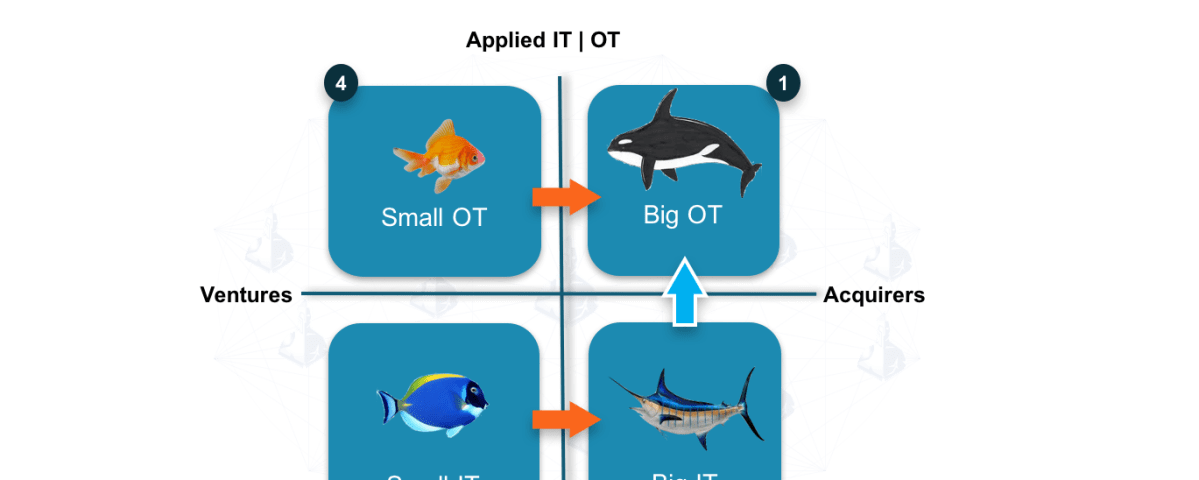

Here is a look at how players from the world of IT and the world of OT (“operational technology”, loosely referring to industrial products and services sectors) are fishing in the venture landscape for investments and acquisitions. This has implications for you whether you are an entrepreneur, a venture investor, a corporate venture / M&A leader, or an investment banker.

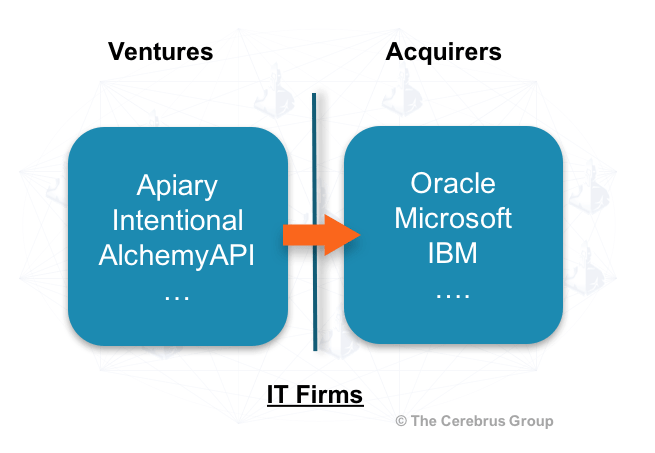

The Simple World of IT acquisitions

We see acquisitions like the ones below often – a small software or hardware firm getting snapped up by an established IT player.

Countless examples of this play out across all parts of the IT stack, from network-server-storage areas to middleware to apps, data, and security. We all expect this: startups building horizontal (industry-agnostic) technology being acquired by large IT players.

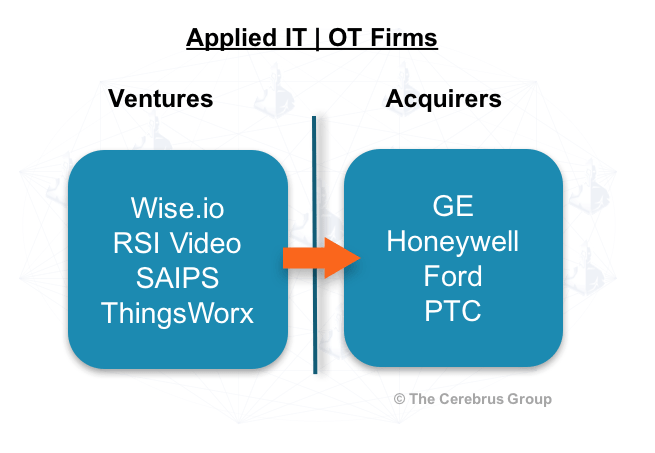

Emergence of New Acquirers

Against the above historical backdrop, we’ve been seeing this new type of acquisitions by vertical-specific large and mega players. A very small sampling of them below.

The school of fish on the left is focused on applying IT to specific vertical industry or operational domain problems. e.g. wise.io for service tickets, SAIPS on AI for vision, ThingWorx for industrial IoT etc. Five years ago these ventures would still have been acquired by traditional IT players. Now there is competition for acquisitions from the industrial sectors.

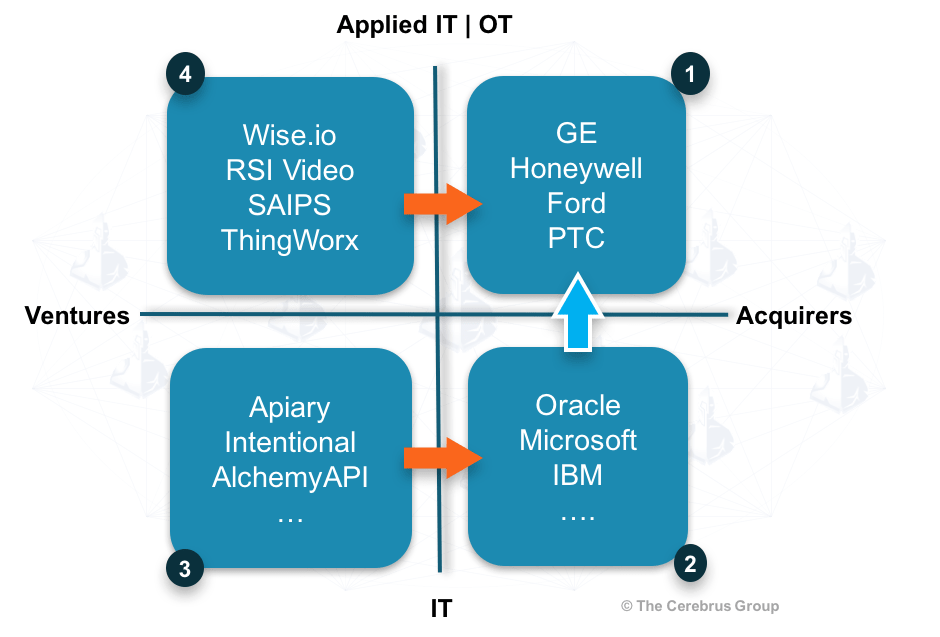

The New World

The graphic below shows both the historic and new dynamic in perspective. Acquirers from quadrants 1, in addition to 2 are scouring the venture landscape, establishing outposts in Silicon Valley and other startup hubs, influencing startup direction and deal flow early, and competing with VC firms for control.

While the classic IT consumption by verticals from the traditional IT players continues (blue arrow), tech products all of a sudden find a new way to reach buyers directly through quadrant 1 vs. indirectly via quadrant 2.

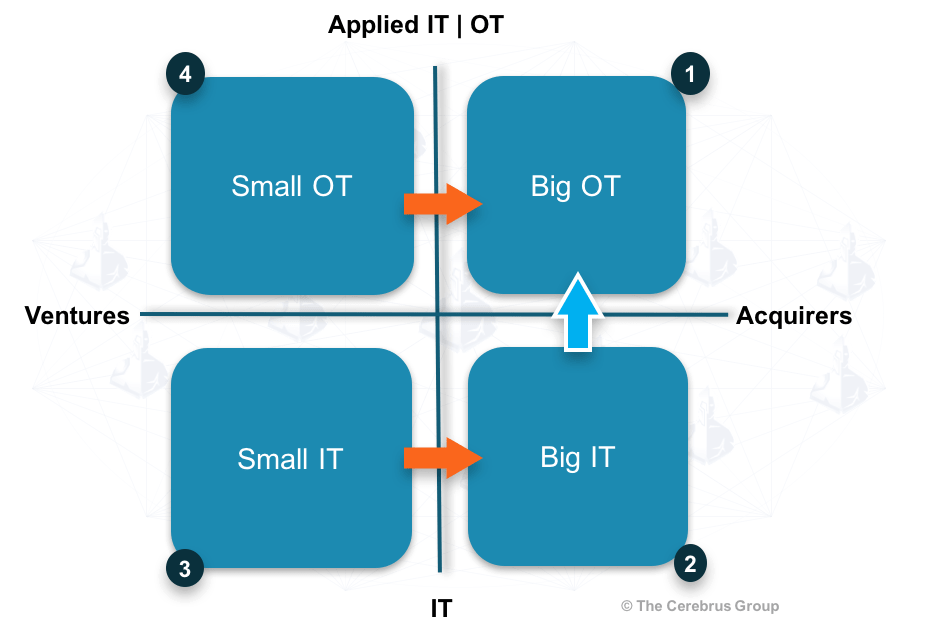

Taxonomy: Small Fish and the Big Fish

Below is a generalization of the acquisition patterns and players by quadrant.

- Big OT: Players not in high-tech sector (e.g. industrial manufacturing, services etc.) or part of their ecosystem

- Big IT: Traditional tech players. Excludes Google, Amazon etc. who don’t fit in a particular quadrant here, but span quadrants 1 and 2.

- Small IT: Focuses on horizontal hardware/software problems that are not industry specific

- Small OT: Small tech players focused on industry problems. (e.g. AI for health or autonomous cars). Their technology focus could be IT or OT, but their problem domain is industry-specific (e.g. SAIPS for navigational AI, Airware in drone technology)

The Calculus of It All

Whether you are an entrepreneur, VC, corporate venture portfolio manager, or investment banker, the interplay across the players in these quadrants has become a key consideration in your day-job. For instance:

- Just as the supply of small technology firms have increased due to cloud, the potential suitors for startups have increased as well. Mature buyers from the OT world are investing in and acquiring from small OT and small IT quadrants.

- Vertical integration across IT and OT is a threat for incumbent OT players (e.g. Google in transportation and robotics, Amazon in health services) and IT players.

- Innovators dilemma problems galore in the big IT quadrant 2. Collectively, they aren’t providing or are unable to provide verticalized solutions while busy trying to stave off cloud competitors. That’s a battle on two fronts simultaneously!

Note: Apple’s acquisition of Lattice Data is another wrinkle in this whole landscape, given the way a corporate acquisition bypassed traditional VC route altogether. Lattice could have exited in quadrant 1 or 2.

The new digital trajectory of venture funding and acquisitions affects many aspects of a venture world such as:

- Product positioning: Are you simply an artificial intelligence software provider or an AI software provider for health?

- GTM: Who exactly is your buyer or channel to the end customer? Is your channel partner a vertical-specific solution provider or an IT solutions provider?

- Funding sources: Can you raise capital from traditional VC firms, corporate ventures in OT, corporate ventures in IT, or even Government?

- Potential exits: Are your suitors in the OT or IT world?

There you have it. The simplified view of the foraging and predatory habits of the various fish and its implications. It’s an exciting marine world out there!